Advertisement

-

Published Date

May 11, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

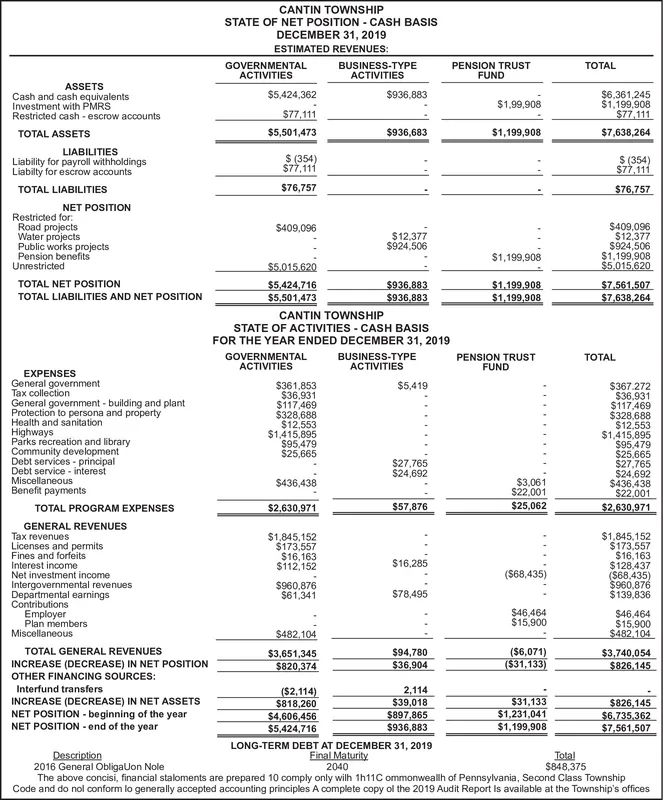

CANTIN TOWNSHIP STATE OF NET POSITION - CASH BASIS DECEMBER 31, 2019 ESTIMATED REVENUES: GOVERNMENTAL ACTIVITIES BUSINESS-TYPE ACTIVITIES PENSION TRUST FUND TOTAL ASSETS Cash and cash equivalents Investment with PMRS Restricted cash - escrow accounts $5,424,362 $936,883 $6,361,245 $1,199,908 $77,111 $1,99,908 $77,111 TOTAL ASSETS $5,501,473 $936,683 $1,199,908 $7,638,264 LIABILITIES Liability for payroll withholdings Liabilty for escrow accounts $ (354) $77,111 $ (354) $77,111 TOTAL LIABILITIES $76,757 $76,757 NET POSITION Restricted for: Road projects Water projects Public works projects Pension benefits Unrestricted $409,096 $12,377 $924,506 $1,199,908 $5.015.620 $409,096 $12,377 $924,506 $1,199,908 $5.015.620 TOTAL NET POSITION TOTAL LIABILITIES AND NET POSITION $5,424,716 $5,501,473 $936,883 $1.199,908 $1,199,908 $7.561,507 $7,638,264 $936,883 CANTIN TOWNSHIP STATE OF ACTIVITIES - CASH BASIS FOR THE YEAR ENDED DECEMBER 31, 2019 GOVERNMENTAL ACTIVITIES BUSINESS-TYPE ACTIVITIES TOTAL PENSION TRUST FUND EXPENSES General government Tax collection General government - building and plant Protection to persona and property Health and sanitation Highways Parks récreation and library Community development Debt services - principal Debt service - interest Miscellaneous Benefit payments $361,853 $36,931 $117,469 $328,688 $12,553 $1,415,895 $95,479 $25,665 $5,419 $367.272 $36,931 $117,469 $328,688 $12,553 $1,415,895 $95,479 $25,665 $27,765 $24,692 $436,438 $22.001 $2,630,971 $27,765 $24,692 $436,438 $3,061 $22,001 TOTAL PROGRAM EXPENSES $2,630,971 $57,876 $25,062 GENERAL REVENUES Tax revenues Licenses and permits Fines and forfeits Interest income Net investment income Intergovernmental revenues Departmental earnings Contributions Employer Plan members Miscellaneous $1,845,152 $173,557 $16,163 $112,152 $1,845.152 $173,557 $16,163 $128,437 ($68,435) $960,876 $139,836 $16,285 (S68,435) $960,876 $61,341 $78,495 $46,464 $15,900 $46,464 $15,900 $482,104 $482,104 TOTAL GENERAL REVENUES INCREASE (DECREASE) IN NET POSITION OTHER FINANCING SOURCES: $3,651,345 $820,374 $94,780 $36,904 ($6,071) ($31,133) $3,740,054 $826,145 Interfund transfers 2,114 $39,018 INCREASE (DECREASE) IN NET ASSETS NET POSITION - beginning of the year NET POSITION - end of the year ($2,114) $818,260 $4,606,456 $5,424,716 $31,133 $1,231,041 $1,199,908 $826,145 $6,735,362 $7,561,507 $897,865 $936,883 LONG-TERM DEBT AT DECEMBER 31, 2019 Final Maturity 2040 Description 2016 General ObligaUon Nole The above concisi, financial staloments are prepared 10 comply only wilh 1h11C ommonweallh of Pennsylvania, Second Class Township Code and do nol conform lo generally accepted accounting principles A complete copy ol the 2019 Audit Report Is available at the Township's offices Total $848,375 CANTIN TOWNSHIP STATE OF NET POSITION - CASH BASIS DECEMBER 31, 2019 ESTIMATED REVENUES: GOVERNMENTAL ACTIVITIES BUSINESS-TYPE ACTIVITIES PENSION TRUST FUND TOTAL ASSETS Cash and cash equivalents Investment with PMRS Restricted cash - escrow accounts $5,424,362 $936,883 $6,361,245 $1,199,908 $77,111 $1,99,908 $77,111 TOTAL ASSETS $5,501,473 $936,683 $1,199,908 $7,638,264 LIABILITIES Liability for payroll withholdings Liabilty for escrow accounts $ (354) $77,111 $ (354) $77,111 TOTAL LIABILITIES $76,757 $76,757 NET POSITION Restricted for: Road projects Water projects Public works projects Pension benefits Unrestricted $409,096 $12,377 $924,506 $1,199,908 $5.015.620 $409,096 $12,377 $924,506 $1,199,908 $5.015.620 TOTAL NET POSITION TOTAL LIABILITIES AND NET POSITION $5,424,716 $5,501,473 $936,883 $1.199,908 $1,199,908 $7.561,507 $7,638,264 $936,883 CANTIN TOWNSHIP STATE OF ACTIVITIES - CASH BASIS FOR THE YEAR ENDED DECEMBER 31, 2019 GOVERNMENTAL ACTIVITIES BUSINESS-TYPE ACTIVITIES TOTAL PENSION TRUST FUND EXPENSES General government Tax collection General government - building and plant Protection to persona and property Health and sanitation Highways Parks récreation and library Community development Debt services - principal Debt service - interest Miscellaneous Benefit payments $361,853 $36,931 $117,469 $328,688 $12,553 $1,415,895 $95,479 $25,665 $5,419 $367.272 $36,931 $117,469 $328,688 $12,553 $1,415,895 $95,479 $25,665 $27,765 $24,692 $436,438 $22.001 $2,630,971 $27,765 $24,692 $436,438 $3,061 $22,001 TOTAL PROGRAM EXPENSES $2,630,971 $57,876 $25,062 GENERAL REVENUES Tax revenues Licenses and permits Fines and forfeits Interest income Net investment income Intergovernmental revenues Departmental earnings Contributions Employer Plan members Miscellaneous $1,845,152 $173,557 $16,163 $112,152 $1,845.152 $173,557 $16,163 $128,437 ($68,435) $960,876 $139,836 $16,285 (S68,435) $960,876 $61,341 $78,495 $46,464 $15,900 $46,464 $15,900 $482,104 $482,104 TOTAL GENERAL REVENUES INCREASE (DECREASE) IN NET POSITION OTHER FINANCING SOURCES: $3,651,345 $820,374 $94,780 $36,904 ($6,071) ($31,133) $3,740,054 $826,145 Interfund transfers 2,114 $39,018 INCREASE (DECREASE) IN NET ASSETS NET POSITION - beginning of the year NET POSITION - end of the year ($2,114) $818,260 $4,606,456 $5,424,716 $31,133 $1,231,041 $1,199,908 $826,145 $6,735,362 $7,561,507 $897,865 $936,883 LONG-TERM DEBT AT DECEMBER 31, 2019 Final Maturity 2040 Description 2016 General ObligaUon Nole The above concisi, financial staloments are prepared 10 comply only wilh 1h11C ommonweallh of Pennsylvania, Second Class Township Code and do nol conform lo generally accepted accounting principles A complete copy ol the 2019 Audit Report Is available at the Township's offices Total $848,375